The UK commercial real estate market has had a difficult few years. One after the other, commercial property has endured a hard Brexit, a global pandemic, and more recently an energy crisis accompanied by rising interest rates.

It’s not just that mortgage repayments are now higher than they have been in many years, but would-be investors in UK commercial property are facing higher debt costs elsewhere.

However, the trend towards working from home is being slowly reined in, which previously hit office values, along with a stabilising post-Brexit outlook. Uncertainty is high all around Europe, meaning that UK-specific uncertainty is improving as highlighted by Rishi Sunak’s growing popularity.

The result of this has been a slight rebound in the commercial real estate outlook. As the recent CBRE report highlights, “income returns, rather than capital growth, is likely to drive commercial real estate returns in the year ahead”. The report stipulates that whilst transaction volume may fall in 2023, the UK will benefit from a diverse internationalised investor base that will play a key role in its performance.

In the lead-up to 2023, UK commercial property has dropped 15% with the lowest level of dealmaking in over a decade. Yet, an opportunity presents itself for overseas investors precisely for that reason.

Record Low Investment Heading Into 2023

UK commercial investment has been turbulent for a long time, with frequent cycles of peaks and troughs. Many offices remained empty in 2022 or for sale in Bromsgrove, as did high street property. Working from home and Amazon-style internet shopping have both been a big factor in this outside of the macroeconomic climate.

Global Anxiety Over Commercial Real Estate

The UK can confide in the fact that commercial real estate is facing difficulties around the world; it’s not only a phenomenon of Brexit. The reaction to record high inflation in the US and Europe led to all three of the Federal Reserve, European Central Bank, and the Bank of England raising rates. Whilst the US lead the way, the resulting banking sector turmoil has made them hesitant to continue raising rates, whilst the ECB must be wary of heavily indebted countries like Spain and Italy which could risk default. This has resulted in the UK’s more sound banking sector and stable balance sheet having the capacity for further UK rates to rise.

The recent banking crisis in the US has also had an impact on European commercial property, which has led to fears of credit becoming more expensive and less available. European investment is facing almost identical issues to the UK too when it comes to high rates, workplace changes, and recession uncertainties.

Signs of Recovery in the UK

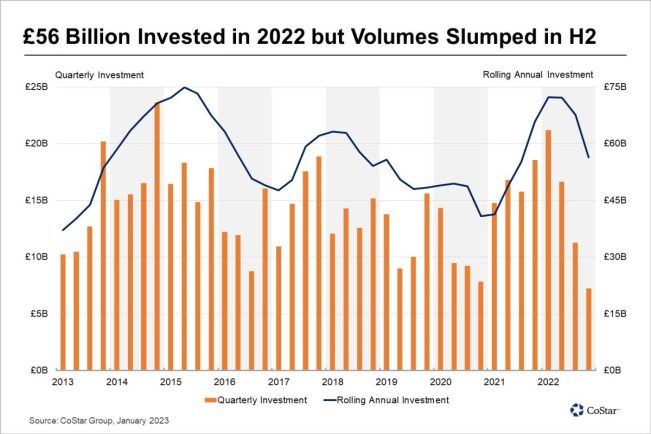

As shown in the CoStar UK data, commercial property has been predictably cyclical, and this alone poses some hope for a rebound in the next 12 months. Forecasts of a mild recession are generally seen as a fair trade-off to lower inflation, meaning that interest rates may no longer need to be raised.

3 months after the FT covered UK commercial property dealmaking “at the lowest level in a decade”, a piece covered dealmaking to be picked up in the first quarter of 2023. Again, this plays into the cyclical notion that rock bottom was hit and had nowhere to go, but nonetheless £6 billion worth of deals for UK offices, industrial, and retail property had been conducted. This is a 24% uptick from the end of 2022, which was off the back of the catastrophic Mini-Budget.

Ed Bradley, who is head of London capital markets at CBRE, told the FT that the UK is seeing greater pragmatism around pricing from vendors, particularly from those with upcoming refinancing.

Asian Investor Influence

Some big-money deals have been made in this first quarter, many of which have been from Asian investors. Deutsche Bank London HQ was sold to a Malaysian firm for £257m, along with Blackstone selling St Katherine Docks in London for £395m to Singapore-listed City Developments Limited.

Foreign investors regularly account for over half of investment volumes into UK commercial property, though foreign contribution was higher than usual in this past quarter. Overseas’ rising interest could be down to a few reasons, such as the recent repricing of commercial property, and a cheaper pound, though it has strengthened more recently.

However, Asian interest specifically derives from a thriving Asian market in the face of European war and recession. Whilst the West deals with an energy crisis and a stalling economy, emerging markets like Malaysia saw almost 9% GDP growth in 2022. With growing wealth in Asia, there’s also a growing capacity for cash buyers that can escape the rising cost of property financing.

And, whilst the Euro was poorly performing along with the pound, many Asian currencies were strengthening in comparison.

This is very much an encouraged strategy by the UK, which has always welcomed foreign investment into the London property market, so much so that it can come with some criticism for being too open.

Beyond the struggles – and thus opportunities – of a cheap pound, it’s also met with a growing supply of cheap money transfer services that are targeting overseas property buyers. Finding cheaper deals means bigger savings when it comes to currency, as it can have a big impact on the final price paid, particularly when hedging against the current volatility.

Remaining challenges and outlook

The difficulty heading into the latter half of 2023 will be how the current concerns play out. Geopolitical tensions are high and energy is being used as a pawn, which is a significant industry for commercial activity.

The liquidity issues of US banks’ maturity mismatching have already impacted many startups, who had deposits and deals from the likes of SVB. The question will be whether the banking crisis is systemic, which would mean a greater impact on the UK, and if it turns from a liquidity problem into an insolvency one.

Investor confidence is difficult to measure in the UK right now. Whilst there are an array of reasons to be pessimistic about post-Brexit Britain, its London-centric finance centre appears somewhat steady and evergreen, along with a growing confidence in Rishi Sunak. Hysteria over the collapse of the pound and Britain regressing into an emerging market seems to have passed, and it’s the diversity of the UK’s internationalised economy – and property market – that provides more stability.

Nonetheless, there is a challenge for sellers to meet redemptions and adjust to pricing changes, particularly with some trusts facing liquidity issues and previously suspended property funds. Major deals like the St Katherine Docks transaction are important in providing much-needed confidence boosts for property investors, as is the stabilising pound and economy.

Whilst HS2 seldom receives any positive coverage, it does pose an opportunity for regional markets outside of the UK. Residential property will likely be boosted due to easier commuting, along with the normalisation of working from home, and this could help boost regional commercial property areas like Bromsgrove as wealth begins to be redistributed away from the capital.